Instruments

An index is a benchmark that tracks the performance of a group of stocks (or other assets) to represent a market segment.

Not directly investable; it's a statistical measure (e.g., weighted average of prices).

Purpose: Gauge overall market health, sector performance, or compare investments.

Examples: S&P 500 (broad U.S. large-cap), Dow Jones (30 major companies).

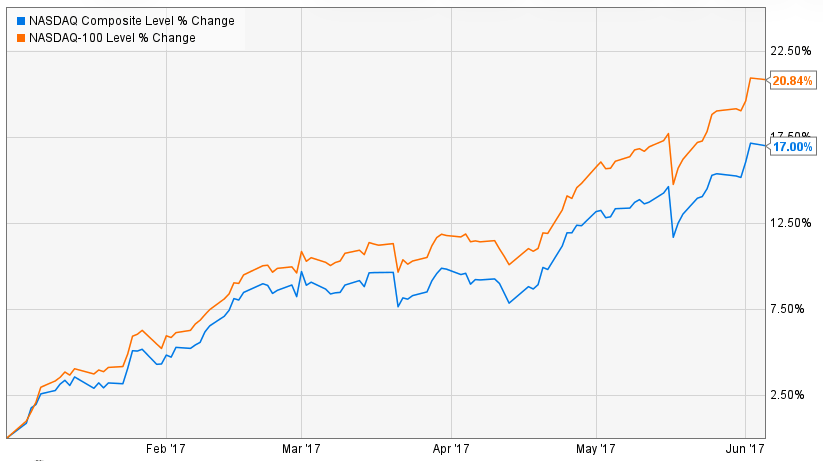

NASDAQ Composite: A broad index including all stocks listed on the NASDAQ exchange (over 3,000+ companies, including domestic and international, across all sectors like tech, finance, healthcare).

Market-cap weighted; heavily tech-influenced but includes financials and smaller companies.

Represents the entire NASDAQ market.

NASDAQ 100: A subset of the 100 largest non-financial companies on NASDAQ (actually ~101-103 securities due to multiple share classes).

Excludes financial firms (e.g., banks); focuses on tech, consumer services, healthcare, etc.

More concentrated on big tech giants (e.g., Apple, Microsoft, Amazon dominate weights).

Key differences: Composite is broader/diversified (includes smaller/financial stocks); NASDAQ 100 is more growth-oriented and tech-heavy, often outperforming in bull markets but more volatile.

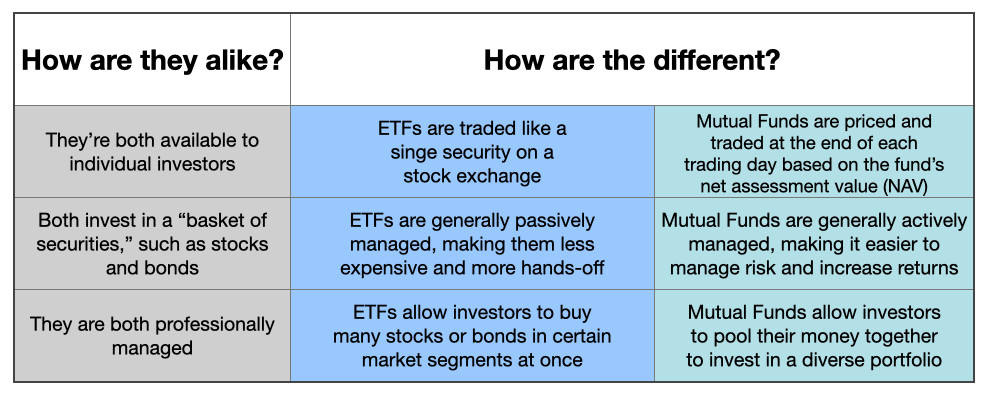

Pooled investment funds that trade on stock exchanges like individual stocks (intraday pricing).

Typically track an index, sector, commodity, or basket of assets (passive) but some are actively managed.

Often hold the actual underlying assets (e.g., stocks in the index).

Advantages: Low costs, liquidity, tax efficiency, diversification.

Example: QQQ tracks the NASDAQ 100; SPY tracks the S&P 500.

Pooled investments similar to ETFs but priced once per day (at net asset value after market close).

Bought/sold directly from the fund company, not on exchanges.

Can be active (manager picks stocks to beat the market) or passive (track an index).

Often higher fees than ETFs due to management.

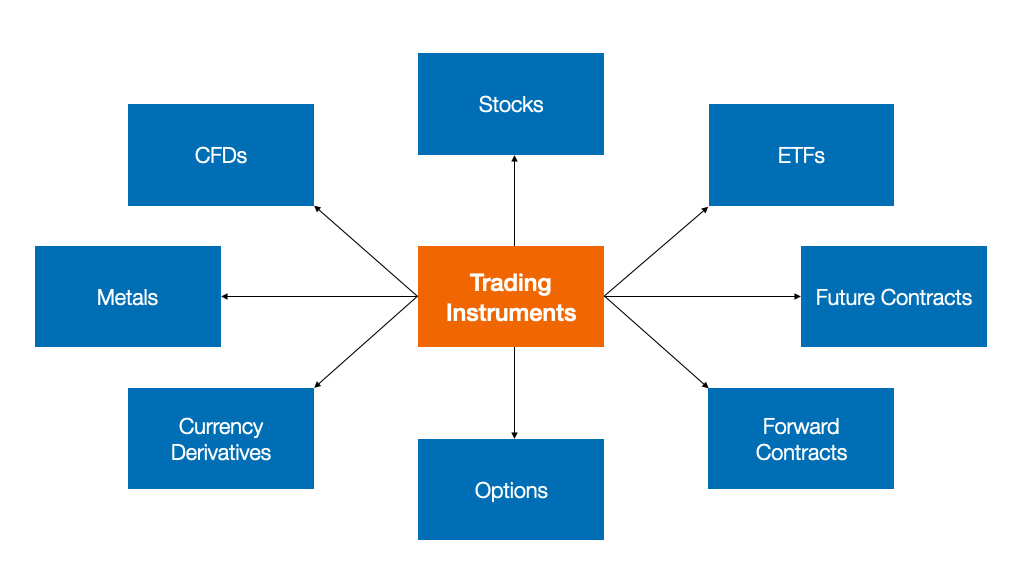

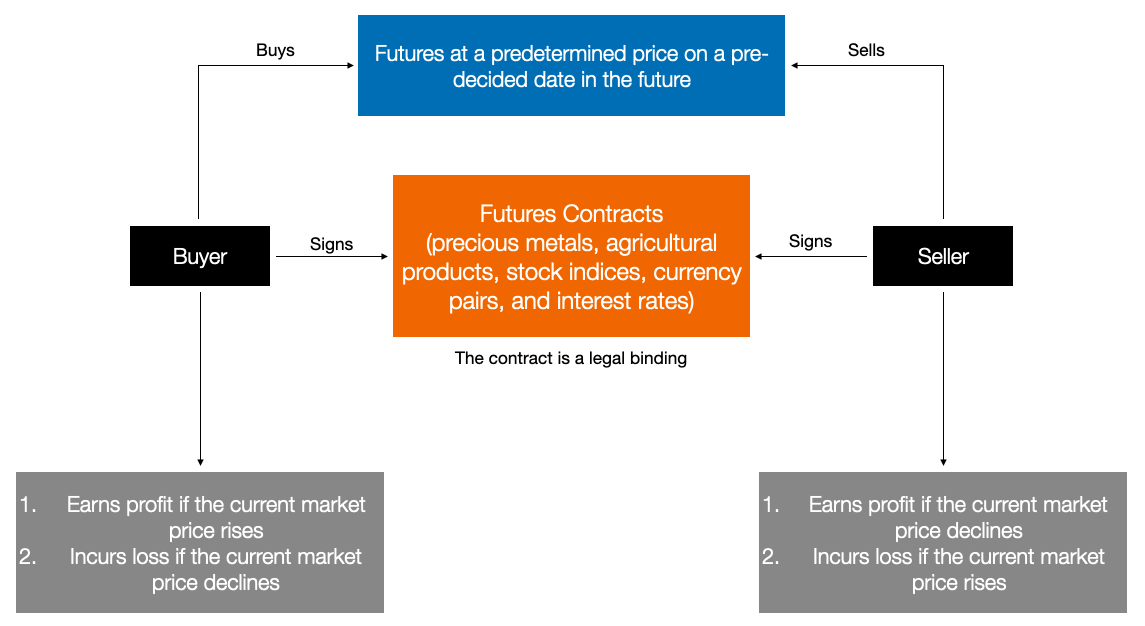

Derivatives are financial contracts whose value is "derived" from an underlying asset, such as a stock, bond, commodity, currency, or index.

They don't represent ownership in the asset itself but allow speculation on price movements or hedging risks.

Common types: Futures, options, forwards, and swaps.

Key features: Often leveraged (control large positions with small capital), traded on exchanges or over-the-counter, and can expire.

Risk: High potential for gains but also significant losses.

A specific type of derivative (futures contract) tied to stocks or stock indices.

It's an agreement to buy or sell a stock (or index) at a predetermined price on a future date.

Unlike buying the stock outright, you don't own it until settlement; it's often cash-settled (e.g., based on index value).

Key features: Often leveraged (control large positions with small capital), traded on exchanges or over-the-counter, and can expire.

Risk: High potential for gains but also significant losses.

Used for: Hedging (protecting against price drops) or speculating on market direction.

Difference from plain stocks: No ownership/dividends; involves margin (borrowed funds) and daily mark-to-market settlement.

Example: E-mini S&P 500 futures track the S&P 500 index performance without buying all 500 stocks.

| Concept | Ownership of Assets? | Traded Like Stocks? | Pricing Frequency | Typical Use/Features | Examples |

|---|---|---|---|---|---|

| Indices | N/A (benchmark only) | No | Real-time calculation | Performance tracking | NASDAQ Composite, S&P 500 |

| ETFs | Yes (holds assets) | Yes | Intraday | Passive indexing; low fees | QQQ (NASDAQ 100), VOO (S&P) |

| Mutual Funds | Yes (holds assets) | No | End-of-day | Active/passive; higher fees possible | Vanguard index mutual funds |

| Derivatives | No | Varies (exchange/OTC) | Real-time | Speculation/hedging; leveraged | Options, swaps |

| Stock Futures | No (until settlement) | On futures exchanges | Real-time | Bet on future prices; margin-based | E-mini NASDAQ 100 futures |

ETFs vs. Mutual Funds: ETFs are more flexible/liquid (trade anytime) and often cheaper/tax-efficient; mutual funds suit end-of-day investors or active strategies.

Indices vs. ETFs/Mutual Funds: You can't buy an index directly—use ETFs/mutual funds to track them.

Futures vs. ETFs: Futures are derivatives (no ownership, higher leverage/risk); ETFs provide actual exposure with less complexity.

These tools help investors gain exposure without buying individual stocks, but always consider risks like market volatility, fees, and taxes.