A free resource explaining core concepts behind refined Smart Money Concepts (SMC), price action analysis, and how modern tools like deep learning can enhance technical trading decisions. No promotions — just clarity.

Educational Resources

Liquidity Pools & Liquidity Sweep

Liquidity pools are clusters of stop-loss orders, pending orders, or equal highs/lows that larger players target to enter or exit positions efficiently. They are commonly found just beyond swing highs (sell-side liquidity) or swing lows (buy-side liquidity).

A liquidity sweep occurs when price rapidly moves to take out these clusters before reversing — often used to fuel the true directional move.

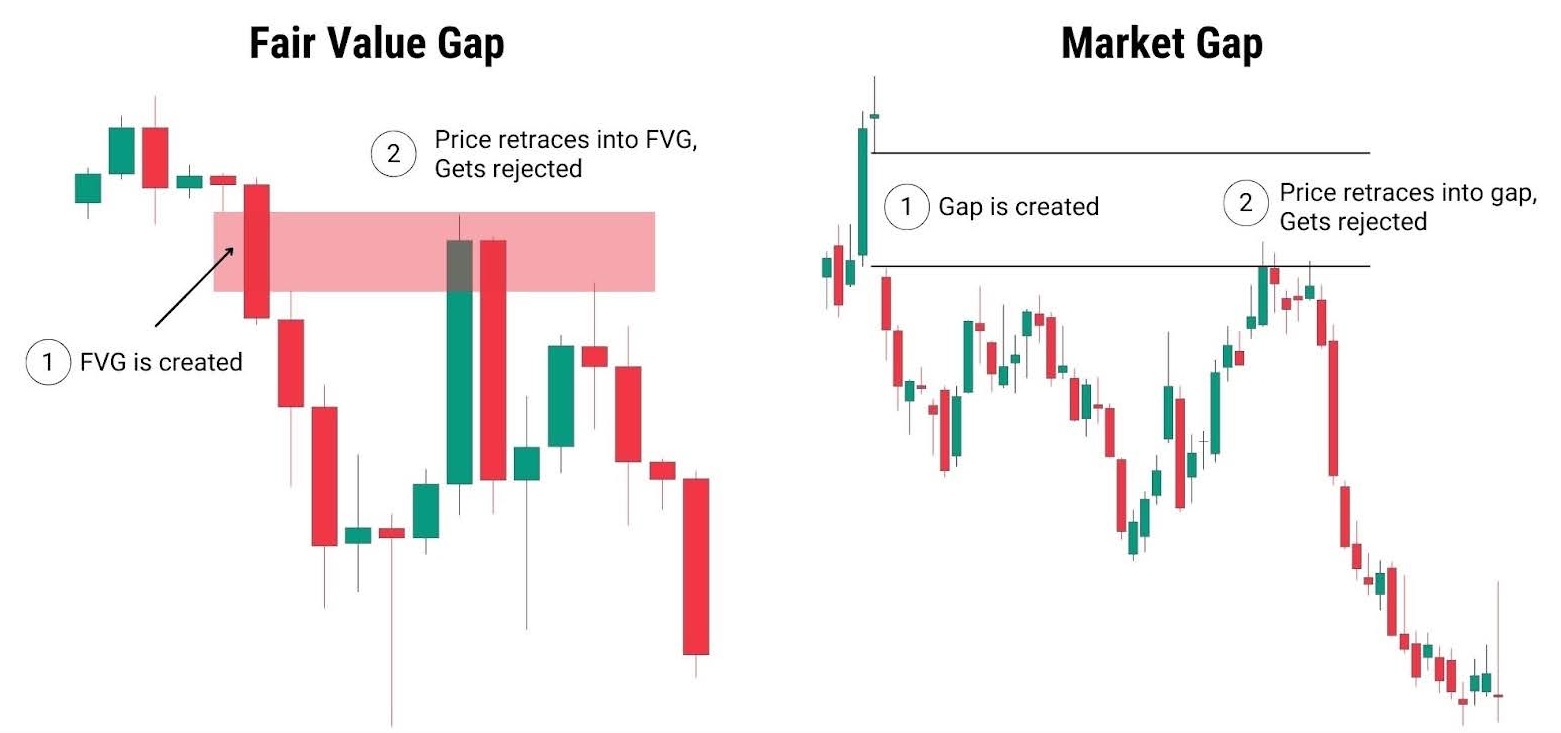

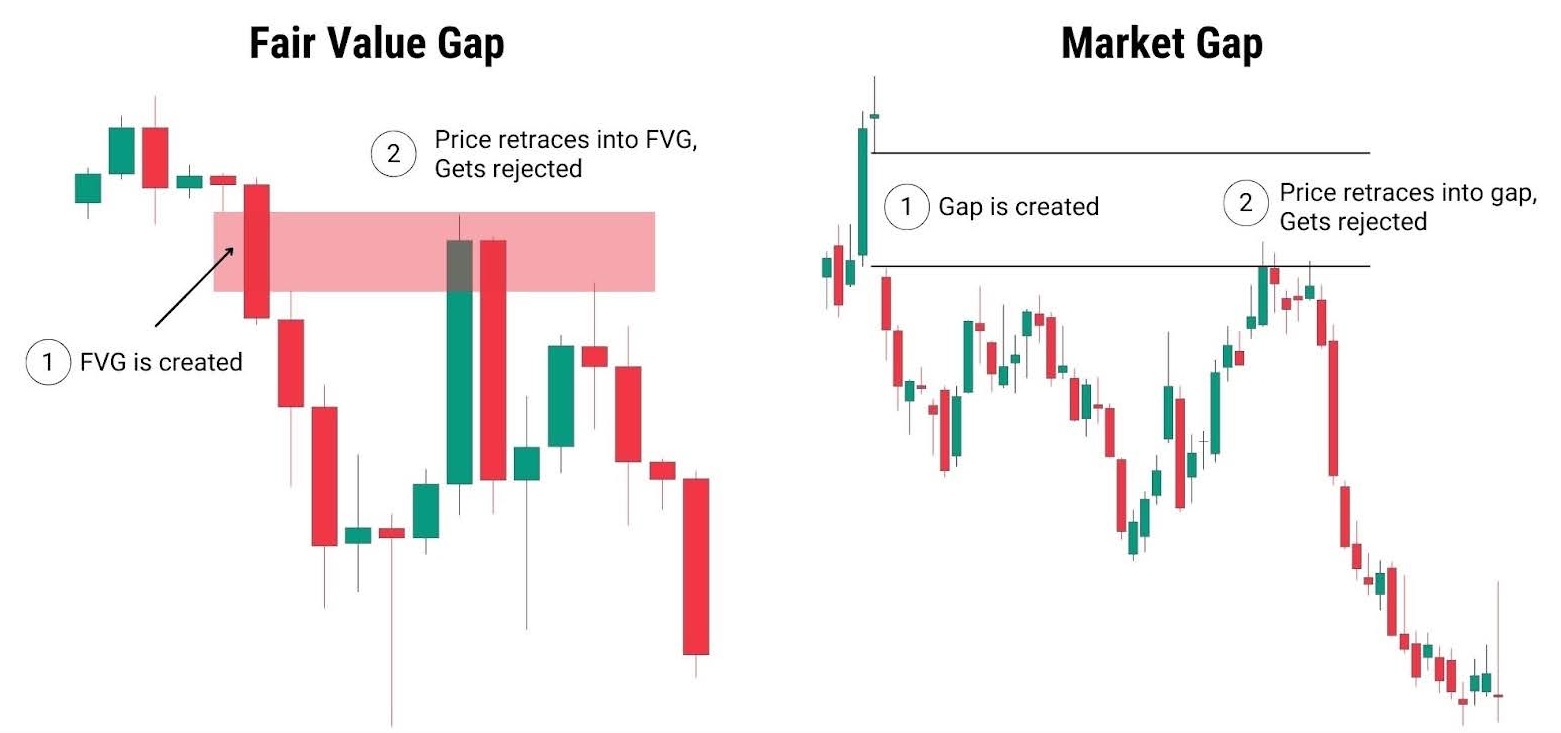

Fair Value Gaps (FVG)

A fair value gap appears when price moves aggressively, creating an inefficiency (a “gap”) between three consecutive candles where the high/low of the middle candle is not overlapped. Markets tend to return to fill these imbalances.

Deep learning models can improve detection and probability assessment of gap fills by analyzing historical resolution patterns.

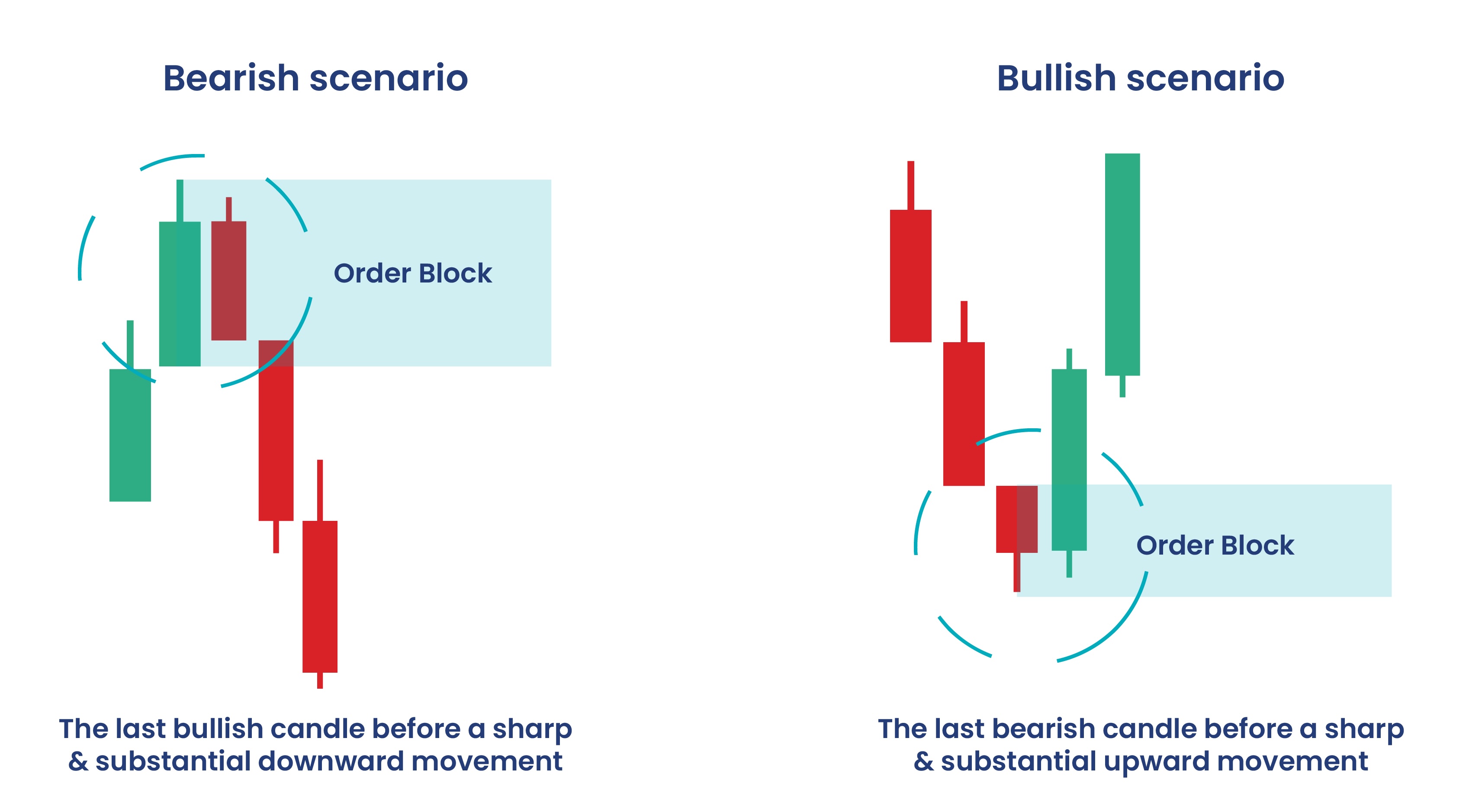

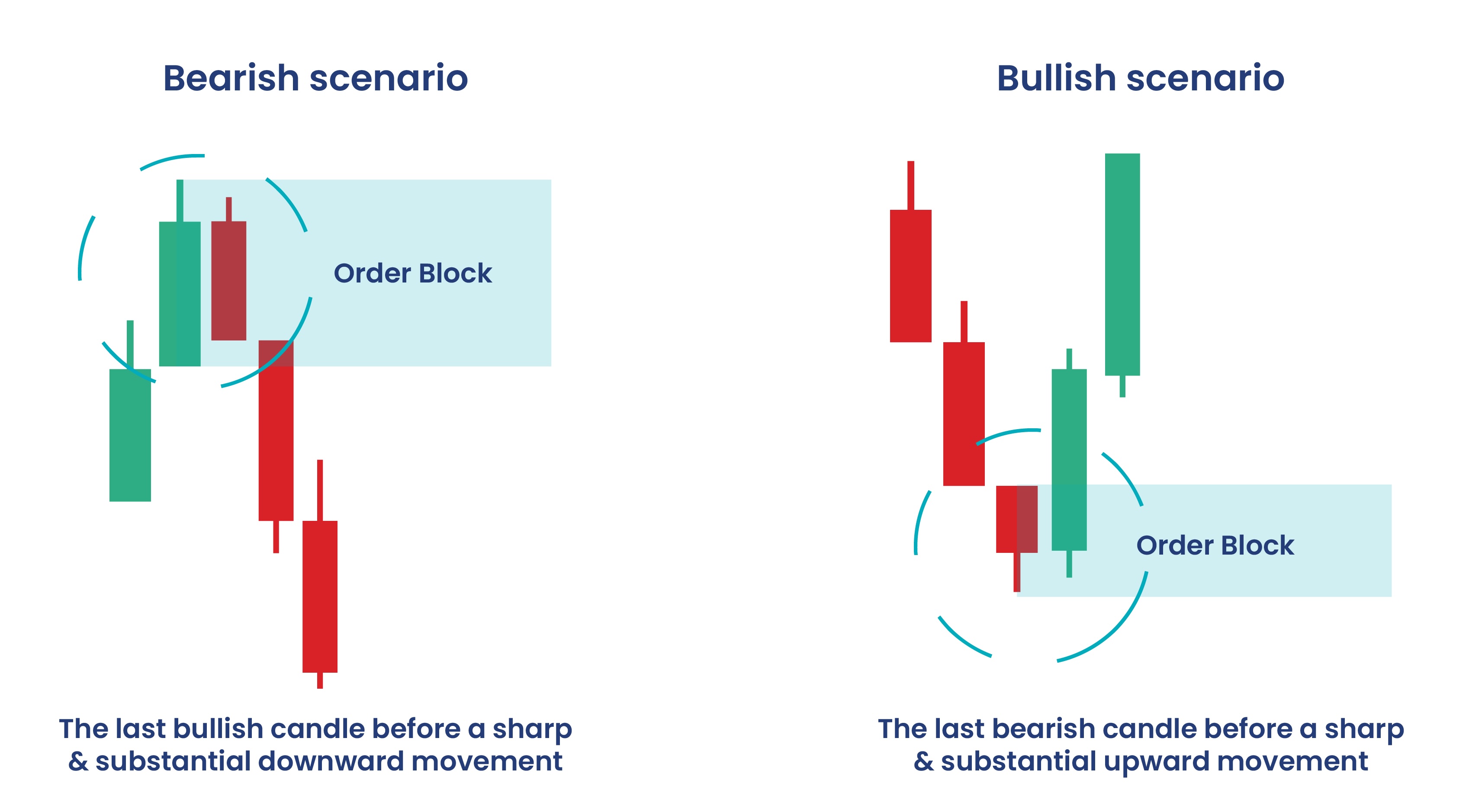

Order Blocks

Order blocks represent areas where significant buying or selling pressure previously occurred — typically institutional accumulation or distribution zones. In SMC frameworks, price often returns to these levels for support/resistance or reversal.

Example: A bullish order block forms at a swing low where aggressive buying halted a downmove. Future price action frequently respects these zones.

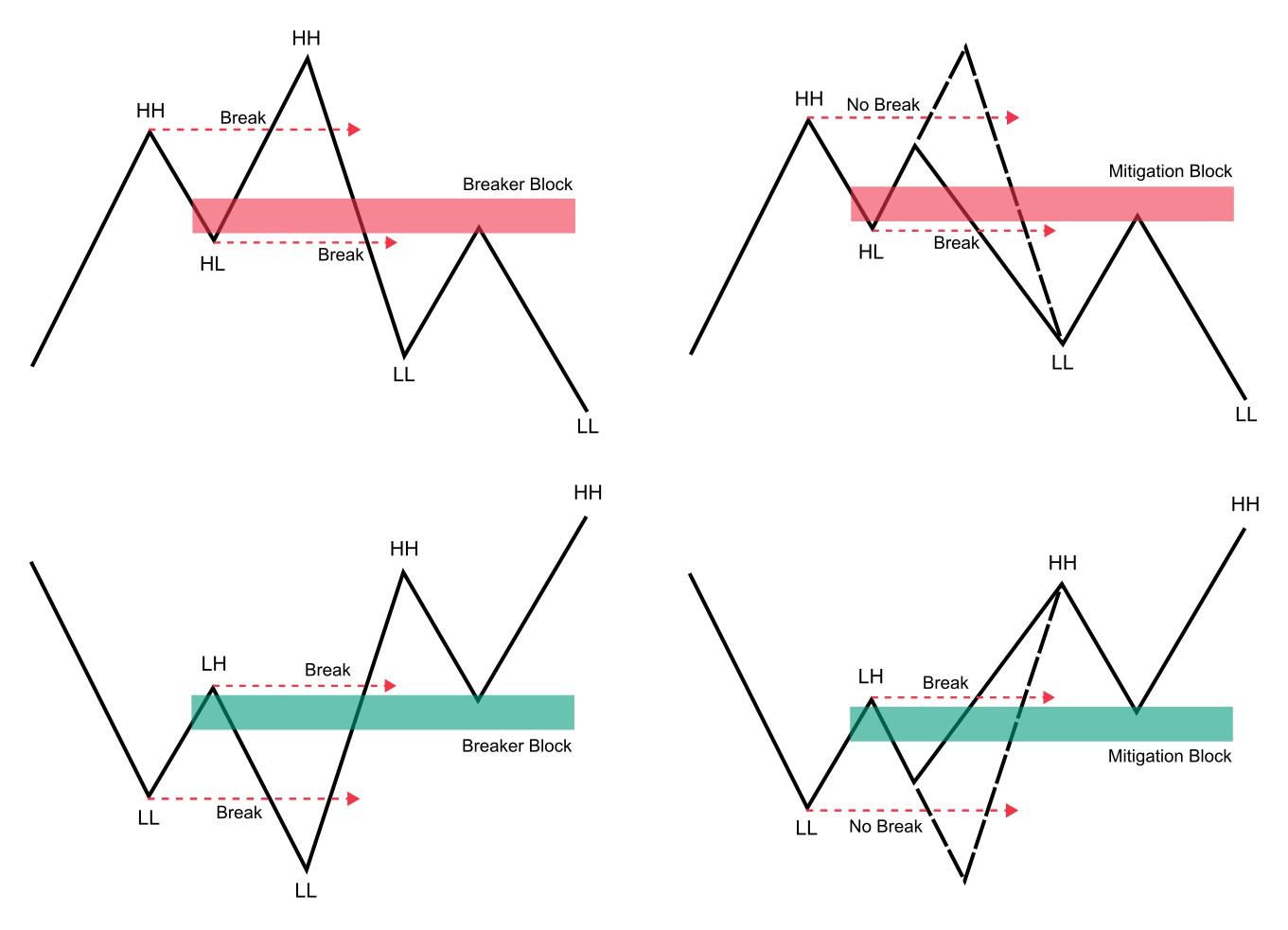

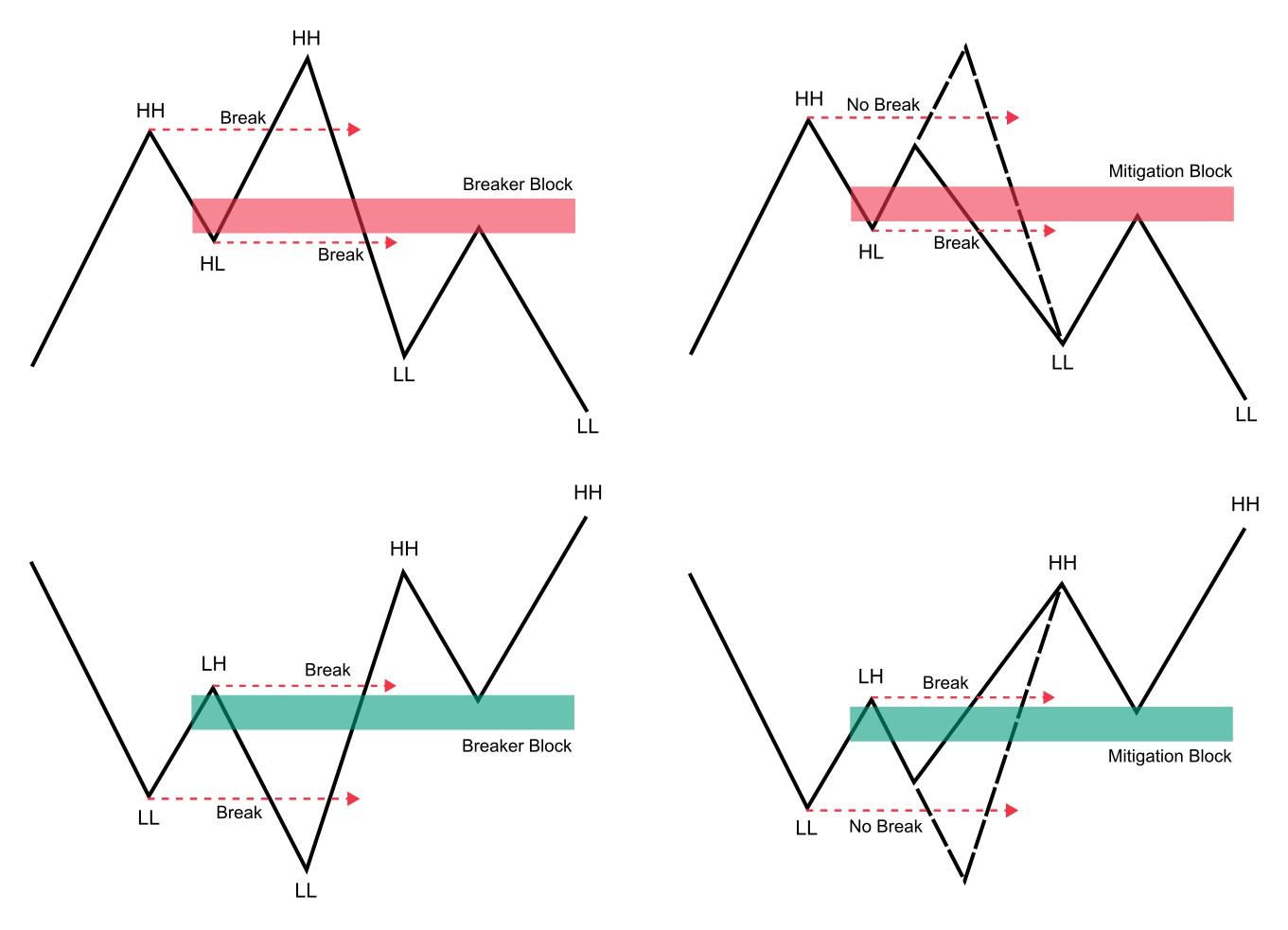

Breaker Blocks & Mitigation Blocks

A breaker block forms when price completely breaks through and closes beyond an existing order block (or mitigation block), invalidating that level. The broken level often “flips” and becomes support or resistance for the new trend direction.

Example: Price was respecting a bearish order block as resistance. Eventually it breaks above it with a strong candle and closes clearly beyond the zone. That old resistance area is now invalidated and frequently turns into new support when price retraces — this flipped zone is the breaker block.

Mitigation blocks are smaller zones inside a larger order block where price has already come back and partially “filled” or reacted to the original imbalance. Instead of fully reversing at the main order block, price mitigates (reduces) part of it first. These mitigated areas often act as secondary or intermediate support/resistance levels, especially during ranging markets or pullbacks.

Example: After a strong bullish move, price returns to a bullish order block. It doesn’t bounce immediately from the whole zone but first reacts at the upper part of it (the mitigation block). This smaller zone can then hold as temporary support on the next pullback.

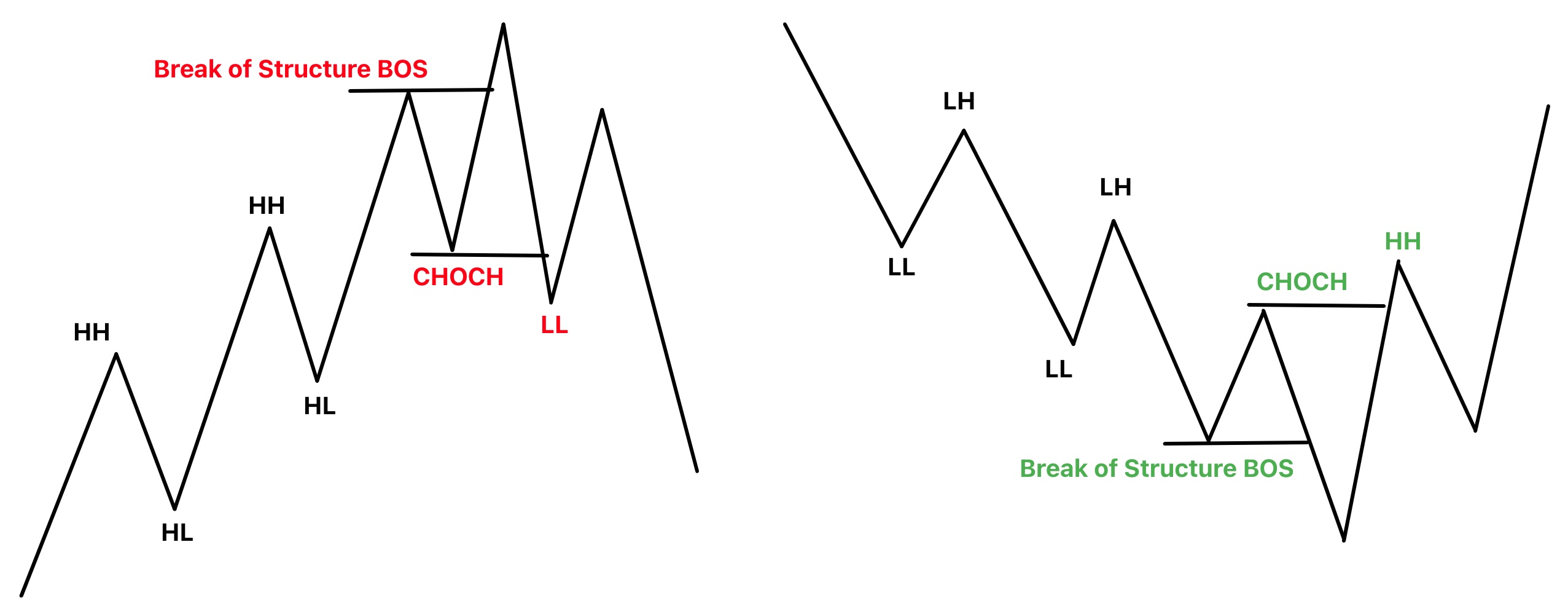

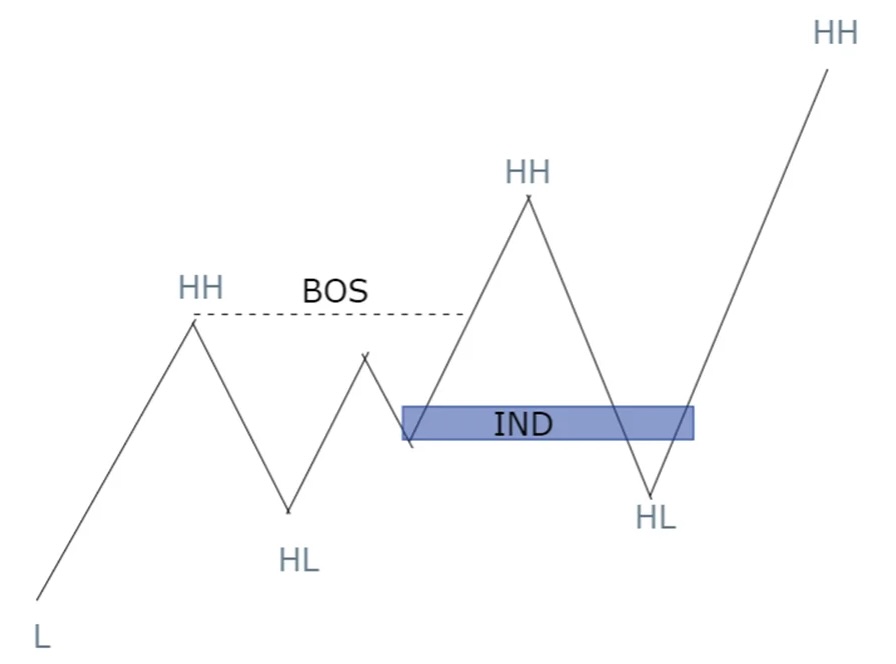

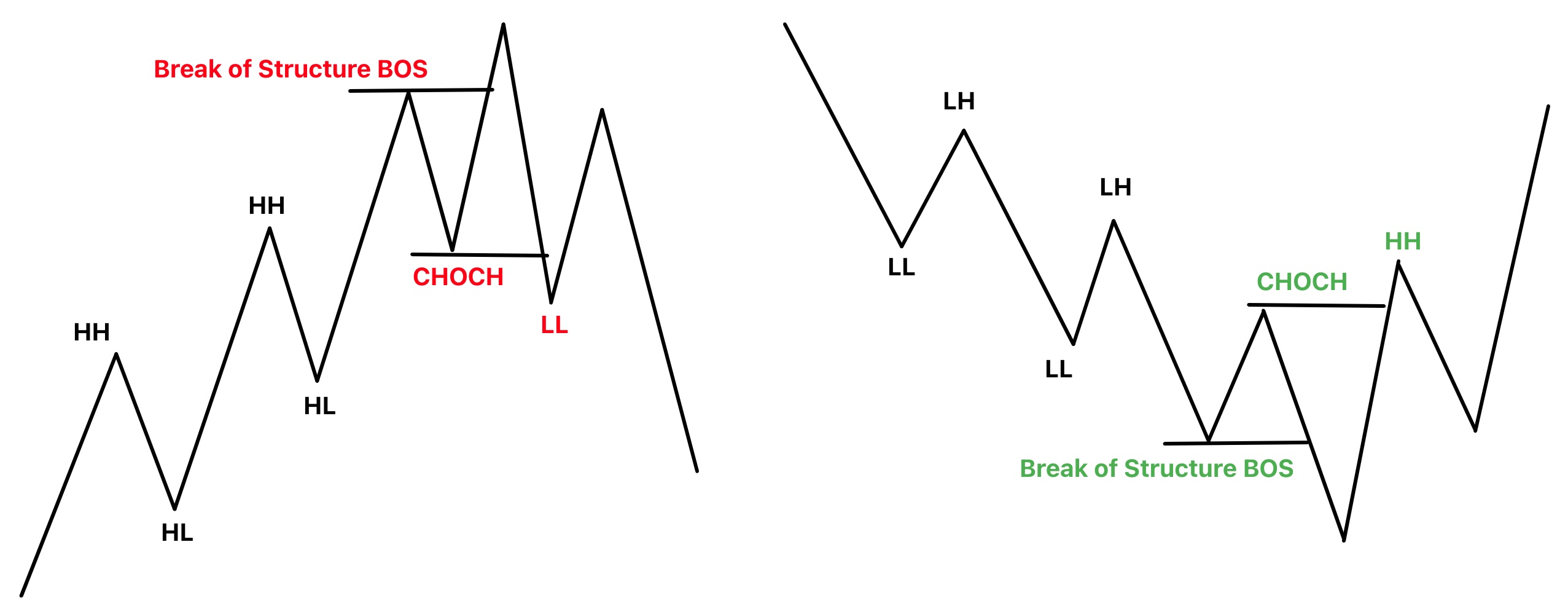

Market Structure & Displacement

Market structure is defined by the sequence of higher highs/higher lows (uptrend) or lower highs/lower lows (downtrend). Displacement refers to strong, impulsive price moves that confirm momentum.

Break of Structure (BOS) confirms trend continuation, while Change of Character (CHOCH) signals the first potential reversal in structure.

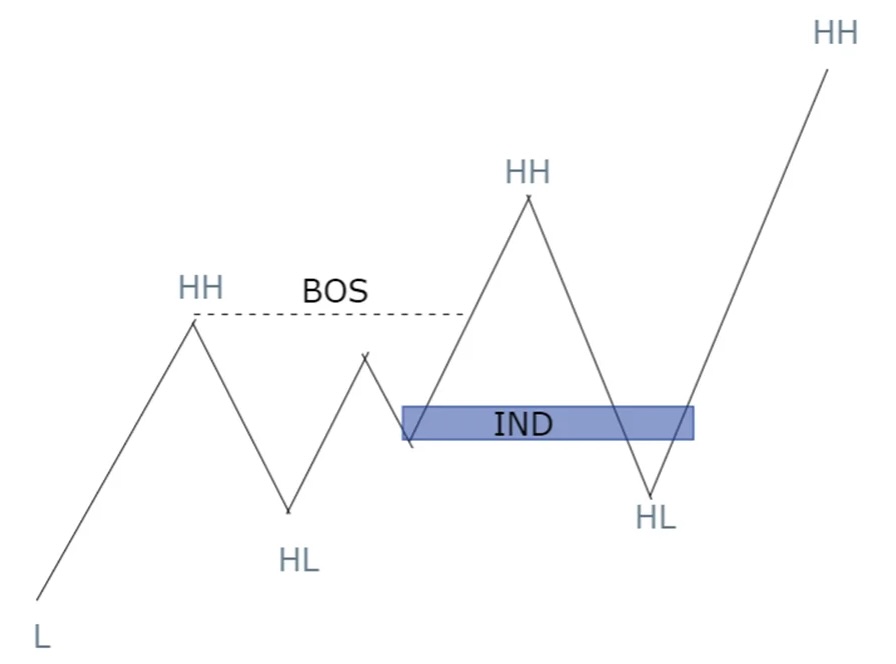

Inducement

Inducement is a deliberate price move designed to trigger retail stops or lure traders into poor positions (often false breakouts or liquidity sweeps) before the real directional move begins.

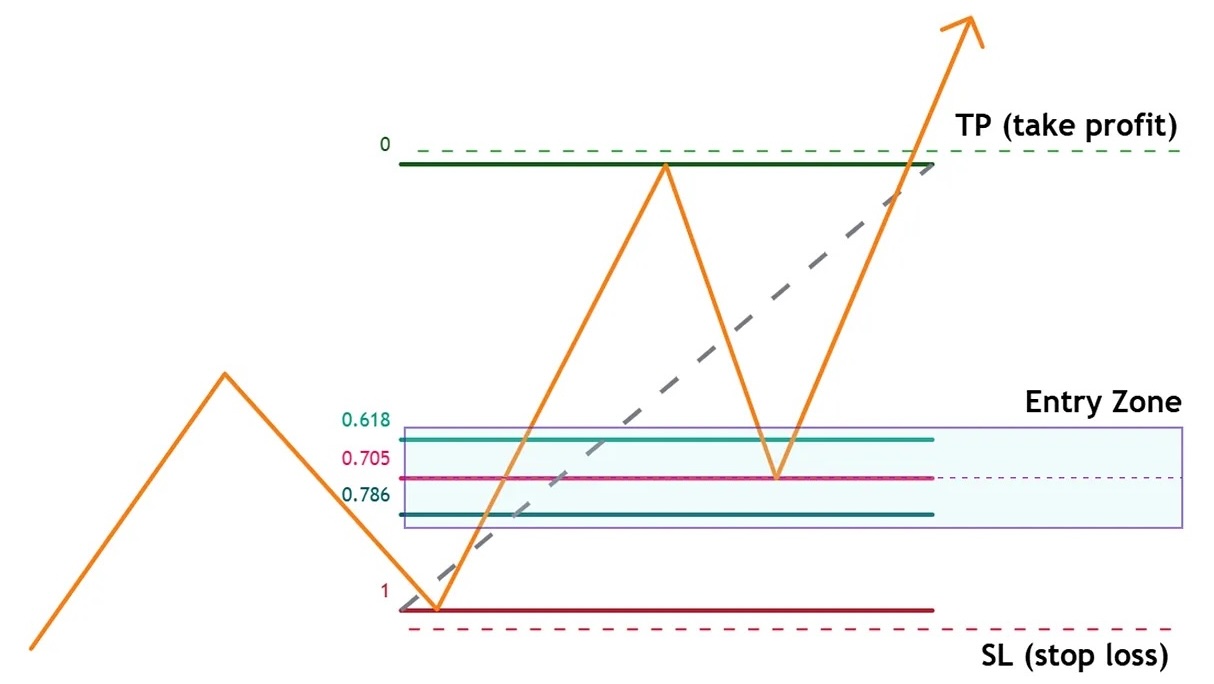

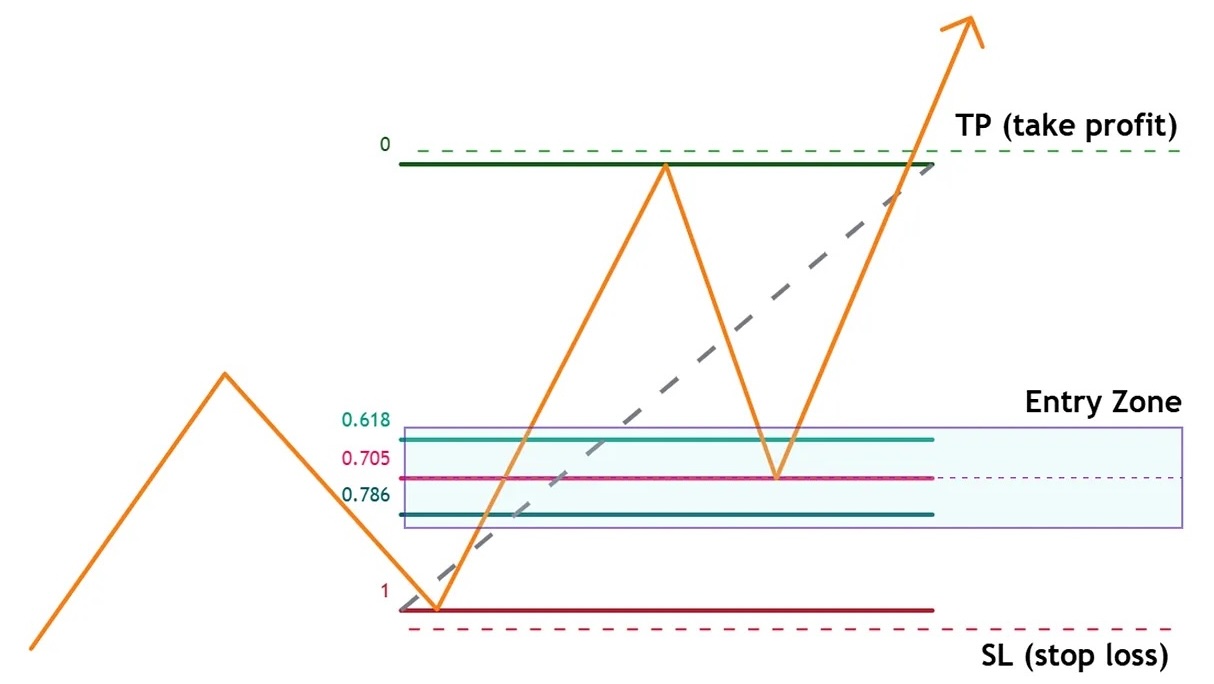

Optimal Trade Entry (OTE)

Optimal Trade Entry is a Fibonacci-based retracement zone (typically 0.618–0.705) within an impulsive move that aligns with institutional order flow, offering high-probability entry points with favorable risk-reward.

Useful Links & Resources

Glossary of Smart Money Concepts

- Liquidity Sweep

- A rapid move that takes out clusters of stops (liquidity) before reversing — commonly used to fuel the opposite directional move.

- Breaker Blocks

- Formed when price breaks and closes beyond a previous order block, invalidating it and turning the area into potential support/resistance for the new direction.

- Mitigation Blocks

- Subsets of order blocks where price has already partially reacted, mitigating some of the original imbalance. They can act as secondary support/resistance in ranging conditions.

- Change of Character (CHOCH)

- The first break of market structure in the opposite direction of the prevailing trend, often signaling the potential start of a reversal.

- Break of Structure (BOS)

- Price closing beyond a previous significant high or low, confirming continuation in the current trend direction.

- Displacement

- Strong, impulsive price movement characterized by large candles and increased volume, confirming conviction behind a trend or reversal.

- Inducement

- A deliberate price move designed to trigger retail stops or lure traders into poor positions before the real directional move begins. Often seen as false breakouts or liquidity sweeps.

- Optimal Trade Entry (OTE)

- A Fibonacci-based retracement zone (typically 0.618–0.705) within an impulsive move that offers high-probability entries aligned with institutional order flow.

All content is for educational purposes only. Trading involves substantial risk and is not suitable for all investors.